Definition Of Accounting – Financial accounting is a specific branch of accounting that involves a process of recording, summarizing and reporting the myriad transactions resulting from business operations over a period of time. These transactions are summarized in the preparation of financial statements, including the balance sheet, income statement, and statement of cash flows, which record the company’s operating performance over a given period.

Job opportunities for a financial accountant can be found in both the public and private sectors. The duties of a financial accountant may differ from that of a general accountant, who works for himself rather than directly for a company or organization.

Definition Of Accounting

Financial accounting uses a number of established accounting principles. The selection of accounting principles to be used in the course of financial accounting depends on the regulatory and reporting requirements facing the company.

Basic Accounting Terms And Definitions [ Class 11 ]

For public companies in the United States, companies must perform financial accounting in accordance with generally accepted accounting principles (GAAP). The establishment of these accounting principles is to provide consistent information to investors, creditors, regulators and tax authorities.

The financial statements used in financial accounting present the five main classifications of financial data: revenues, expenses, assets, liabilities and equity. Income and expenses are accounted for and reported on the income statement. They can include everything from R&D to payroll.

Financial accounting results in the determination of net profit at the bottom of the income statement. The accounts of assets, liabilities and equity are presented in the balance sheet. The balance sheet uses financial accounting to report ownership of the company’s future economic benefits.

A balance sheet reports a company’s financial position at a specific date. The balance sheet reports on the company’s assets, liabilities and equity, and the financial statement is carried over from one period to the next. Financial accounting guidelines dictate how a company records cash, values assets and reports debt.

What Are Accounting Ratios? Definition And Examples

Management, lenders, and investors use a balance sheet to assess a company’s liquidity and solvency. By analyzing the financial relationship, financial accounting allows these parties to compare one balance sheet account with another. For example, the current ratio compares the amount of current assets to current liabilities to determine how likely a company is to meet short-term debt obligations.

An income statement reports on a company’s operating activity over a specific period of time. Often reported on a monthly, quarterly, or annual basis, the income statement reports a company’s revenue, expenses, and net income for a given period. Financial accounting guidance dictates how a business recognizes revenue, records expenses, and classifies types of expenses.

An income statement is useful for management, although cost accounting techniques can enable a company to determine better production and pricing strategies compared to financial accounting. In contrast, financial accounting rules regarding an income statement are more useful to investors looking to see a company’s profitability and outside parties looking to assess the risk or consistency of operations.

A statement of cash flows reports how a company used cash during a specific period. The report is divided into sections summarizing the sources and uses of exploitation, financing and investment. Financial accounting guidelines dictate when transactions should be recorded, although there is often little or no flexibility in the amount of cash to be reported per transaction.

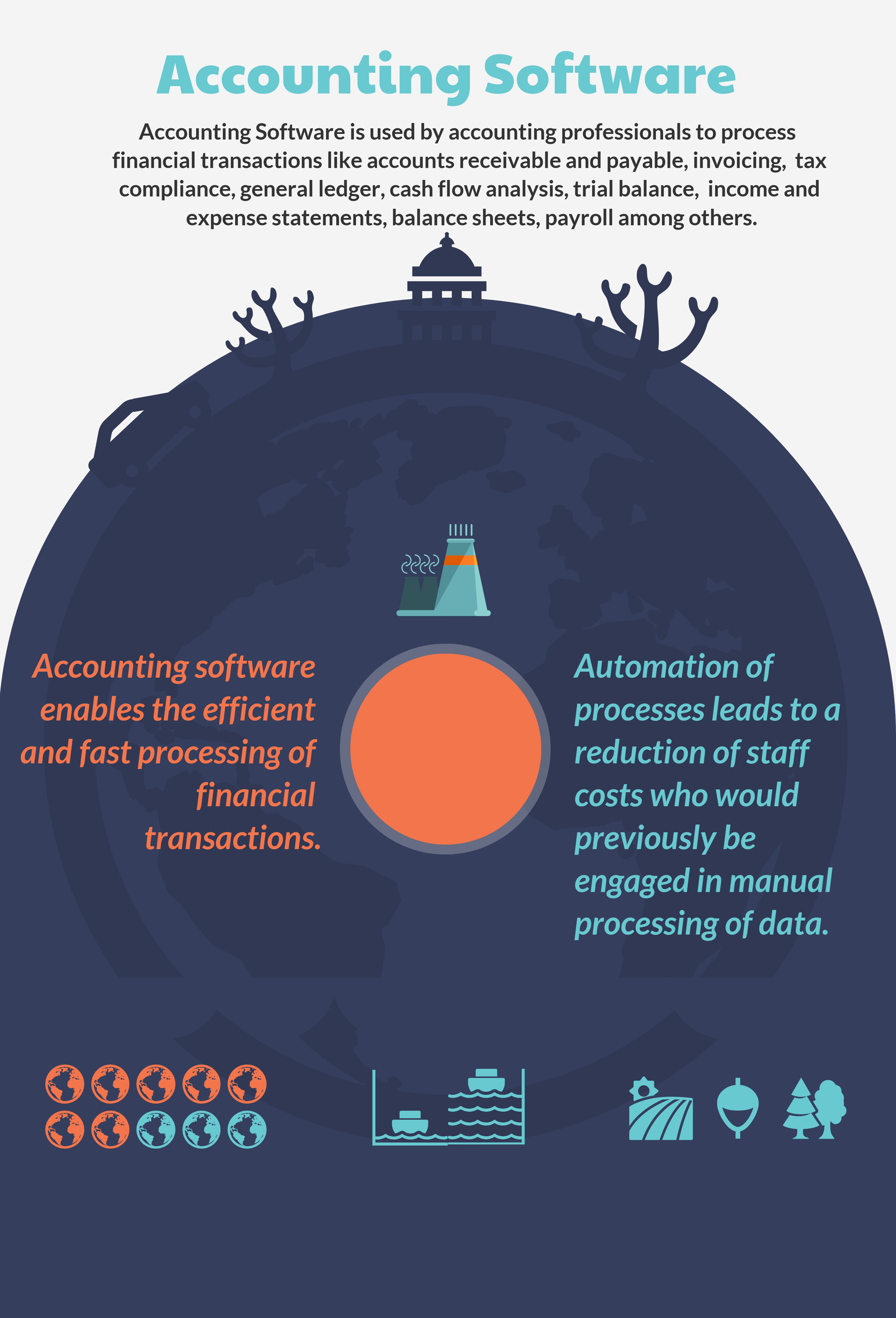

What Is Accounting Software? Analysis Of Features, Types, Benefits And Pricing

A statement of cash flows is used by management to better understand how cash is being spent and received. Financial accounting that requires accrual accounting records transactions that have been paid for, as well as transactions where the cash flow has not yet occurred. A cash flow statement pulls out only the items that affect cash, allowing for greater analysis of how money is specifically being used.

A statement of net worth reports how a company’s equity changes from one period to another. The report shows how a company’s residual value is increasing or decreasing, as well as why the residual value has changed. The statement of changes in equity summarizes a company’s net income, dividend distributions, distributions to property, and other changes in equity.

Nonprofits and government agencies use a similar financial statement; however, your financial statements are more specific to your entity types and will vary from the statements listed above.

There are two main types of financial accounting: the accrual method and the cash method. The main difference between the two types of financial accounting is when transactions are recorded (or not).

What Is An Accounting Cycle? (2023)

The accrual method of financial accounting is a method of preparing financial statements that records transactions regardless of the use of cash. Journal entries may be posted before an item is due, and certain financial accounting principles recognize the impact of a transaction over a period of time (as opposed to recording the entire impact in the period in which the cash impact occurred).

For example, imagine a company receives a payment of $1,000 for consulting work to be completed next month. Under the accrual method of financial accounting rules, the company cannot recognize the $1,000 as revenue because the company technically has not performed any work and earned the revenue. Under the accrual method of financial accounting, this transaction is recorded as a debit to Cash and a credit to Unearned Revenue, a liability account. When businesses earn revenue next month, clear the unearned revenue accounting and record actual revenue.

Another example of the accrual method of accounting is expenses that have not yet been paid. Imagine a company received a bill for $5,000 for July utility usage. Although the company will not pay the invoice until August, the accrual method of accounting calls for the company to record the transaction in July. In addition to debiting utilities, the company records a credit to Accounts Payable. When the bill is paid, the credit is cleared.

The cash method of financial accounting is an easier and less stringent method of preparing financial statements. Under the cash method, transactions are recorded only when cash is present. Income and expenses are only recorded when the transaction is completed by providing money.

What Is Accounting? Definition, Objectives, Functions, Need

In the example above, the consulting firm would have recorded $1,000 of consulting revenue when it received payment. Even though you won’t actually perform the work until the following month, the cash method requires that revenue be recognized when the cash is received. When the company does the work the following month, no journal entry is recorded because the transaction will have been recorded in full in the previous month.

In the other example, the utility expense would have been recorded in August (the period in which the bill was paid). Although the charges relate to services incurred in July, the cash method of financial accounting requires that expenses be recorded when they are paid, not when they are incurred.

Financial accounting is dictated by five general and general principles. These principles guide how companies should prepare their financial statements and are the basis of all financial accounting technical guidelines. These five principles relate to the accrual accounting method.

Careers in financial accounting may include, but are not limited to, preparing financial statements, analyzing financial statements, auditing financial statements, or supporting the technology or systems that produce financial statements.

Wealth Definition Shows Fortune Accounting Hi Res Stock Photography And Images

The whole purpose of financial accounting is to prepare financial statements. These financial statements are used by various groups and are often required as part of agreements with the company that prepares the financial statements. In addition to management using financial accounting to obtain information about operations, the following groups use financial accounting reports:

The key difference between financial and management accounting is that financial accounting aims to provide information to parties outside the organization, while management accounting information aims to help the managers of the organization to to take decisions.

Financial accounting is the set of rules used to prepare a company’s financial statements. Alternatively, cost accounting is a series of accounting techniques used to analyze financial performance and drive smarter decision making. Financial accounting is the basis of externally shared financial statements; Cost accounting is not a permitted basis for financial statements.

Cost accounting is based on using operational information in specific ways to obtain information. For example, cost accounting can track variable costs, fixed costs, and overhead costs throughout a manufacturing process. Then, using this information, a company can decide whether to convert to a lower quality, less expensive type of raw material. While businesses rely on financial accounting to prepare financial statements, businesses rely on cost accounting to internally analyze operations and generate internal-only reports.

Construction Accounting Basics Every Contractor Should Know

The income statement of a public company is an example of financial accounting. The company must follow specific guidance on which transactions to record. In addition, the format of the report is stipulated by the governing bodies. The final result is a financial report that communicates the amount of revenue recognized in a given period.

Financial accounting aims to provide financial information about a company’s operating performance. Although management can analyze reports generated using financial accounting, they often find it more useful to use managerial accounting, an internally oriented method of calculating financial results that is not allowed for external reporting. Financial accounting is the widely accepted method of preparing financial results

Definition of public accounting, definition of inventory accounting, definition of forensic accounting, definition of accounting software, definition of business accounting, definition of accounting systems, definition of tax accounting, definition of project accounting, definition of accounting pdf, definition of fund accounting, definition of accounting aicpa, definition of accounting principle